kentucky sales tax on-farm vehicles

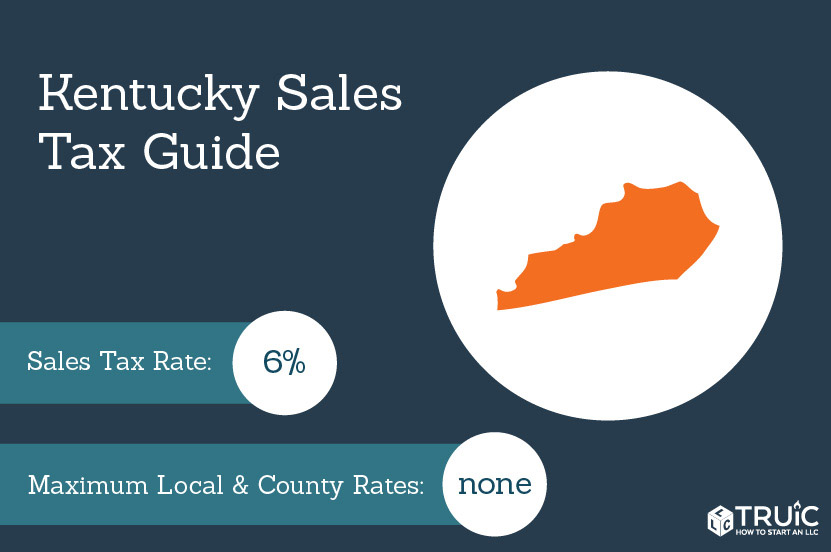

For Kentucky it will always be at 6. Kentucky Sales Tax Rate - 2022.

To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. Labor and services associated with the repair installation and maintenance of taxable tangible personal property. How to Calculate Kentucky Sales Tax on a Car.

650 Definitions for KRS 186650 to. 650 Definitions for KRS 186650 to. Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort KY 40602-0181.

Are services subject to sales tax in Kentucky. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Effective July 1 2018 sales and use tax is also imposed on.

For Kentucky it will always be at 6. This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs. Exempt from weight distance tax in Kentucky KYU.

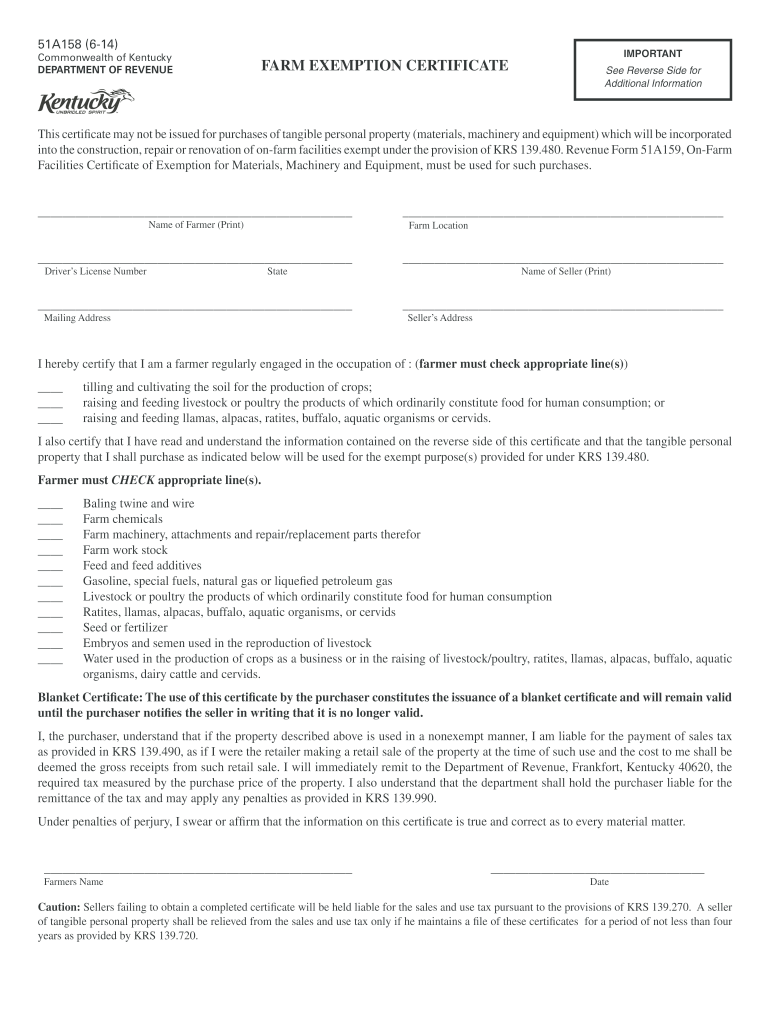

For example Kentucky exempts from tax feed farm. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky. To calculate the sales tax on your vehicle find.

For vehicles that are being rented or leased see see taxation of leases and rentals. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. In addition to taxes car. Or vehicles with 3 or more axles regardless of weight to.

How This Farmer S Amazon Career Helps Him Feed His Community

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Registration Renewal Vehicle Registration Renewal Drive Ky Gov

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Kentucky Solar Farm Invite Is Not Sitting Well With Rural Neighbors

How To File And Pay Kentucky Kyu Weight Distance Tax Step By Step Youtube

Form 51a158 Fillable Farm Exemption Certificate

Filing A Kentucky State Tax Return Credit Karma

Motor Vehicle Taxes Department Of Revenue

Dump Trucks For Sale In Kentucky 37 Listings Truckpaper Com Page 1 Of 2

Kentucky Tractors For Sale Equipment Trader

Farm Exemption Kentucky Fill Online Printable Fillable Blank Pdffiller

Illinois Sales Tax Exemptions On Farm Equipment

Kentucky Sales Tax Small Business Guide Truic

Form 51a158 Fillable Farm Exemption Certificate

Ky Farmers Required To Apply For New Sales Use Tax Exemption Number News State Journal Com

Sales Tax Laws By State Ultimate Guide For Business Owners

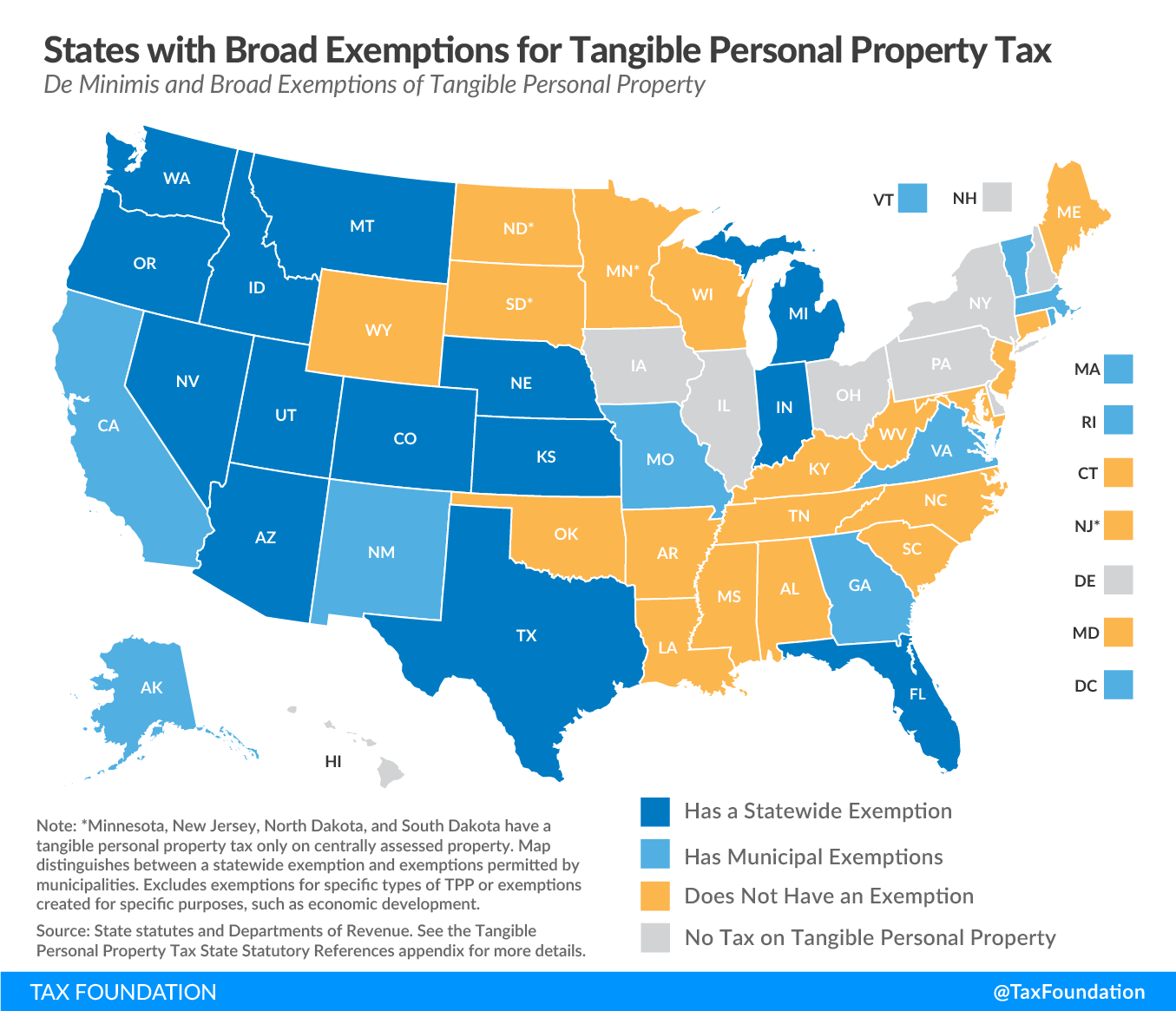

Tangible Personal Property State Tangible Personal Property Taxes