property tax calculator frisco tx

Calculate your Collin County property tax amount for. If you do not have a statement contact the Collin County appraisal district.

Why Are Texas Property Taxes So High Home Tax Solutions

Pin By Business Directory On Minnesota Nature Garland Tx Beauty Services Financial Services.

. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county. Please select your city.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Sales Tax State Local Sales Tax on Food. At this point property owners usually order service of one of the best property tax attorneys in Frisco TX.

Texas taxes on a pack of 20 cigarettes totals 141 which ranks in the middle of the pack on a nationwide basis. This can be found on your Collin County Notice of Appraised Value statement. This home was built in 2020 and last sold on 142021 for 400000.

The Collin County tax bill now includes Collin County City of Frisco Frisco ISD and Collin County Community College district taxes. View the Full Range of County Assessor Records on Any Local Property. Real property tax on median home.

Create an Account - Increase your productivity customize your experience and engage in information you care about. Please select your county. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Enter the value of your property. Collin County collects on average 219 of a propertys assessed fair market value as property tax. Enter your Over 65 freeze year.

Please select your school. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar. Property tax calculator frisco tx Monday February 28 2022 Edit.

This type of an agreement means the cost you pay is restricted to a percentage of any tax. Property Tax Statements are mailed out in October and are due upon receipt. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

Collin County has one of the highest median property taxes in the United States and is ranked 48th of the 3143 counties in order of median property taxes. Pay property taxes on time. That being said Texas does fund many of their infrastructure projects etc.

Please select your city. Enter the value of your property. Enter your Over 65 freeze year.

Those property owners living in Denton County will still receive 2 statements. The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000. You will need your Collin County appraised value and the names of the taxing units that apply to your property.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Calculate an estimate of your property taxes. Enter your Over 65 freeze year.

A Frisco Property Records Search locates real estate documents related to property in Frisco Texas. One of the fantastic things about living in Texas is the absence of a state income tax. View photos map tax nearby homes for sale home values school info.

Enter your Over 65 freeze amount. Property taxes in Texas are among the highest in the country. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

This calculator factors in PMI Private Mortgage Insurance for loans where less than 20 is put as a down payment. To avoid penalties pay your taxes by January 31 2022. Effective property tax rates average 169 meaning Texan households pay an average of 3390 in property taxes each year.

School Board Drops Tax Rate for Third Straight Year Frisco Property Taxes Frisco Rmends Raising Property Taxes Texas Scorecard Frisco property tax rate to remain unchanged for 2020 PISD adopts same tax rate for fifth year in a row Plano Star. 1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of Frisco taxes due. Enter your Over 65 freeze amount.

Youll pay only when theres a tax. How to Get Your Taxes Reduced for Free. Public Property Records provide information on land homes and commercial properties in Frisco including titles property deeds mortgages property tax.

Property Tax Rate Comparisons around North Texas. Enter your Over 65 freeze amount. For more information call 469.

Please choose your exemption. Youll pay only when theres a tax decrease when you join with protest firms on a contingent fee basis. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

This mortgage calculator can be used to figure out monthly payments of a home mortgage loan based on the homes sale price the term of the loan desired buyers down payment percentage and the loans interest rate. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years. This is quite appealing to those relocating from many other states around the nation.

0 Rolater Rd is a property in Frisco TX 75035. Property tax calculator frisco tx Monday February 28 2022 Edit. Ad Search Property Tax Records from Home Without Lines or Paperwork.

Enter the Address Here.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Homestead Exemption Overview Mortgagemark Com

Taxes Celina Tx Life Connected

What Is The Property Tax Rate In Frisco Texas

Tarrant County Tx Property Tax Calculator Smartasset

Cook County Il Property Tax Calculator Smartasset

Where Are Lowest Property Taxes In North Texas

What Is The Property Tax Rate In Frisco Texas

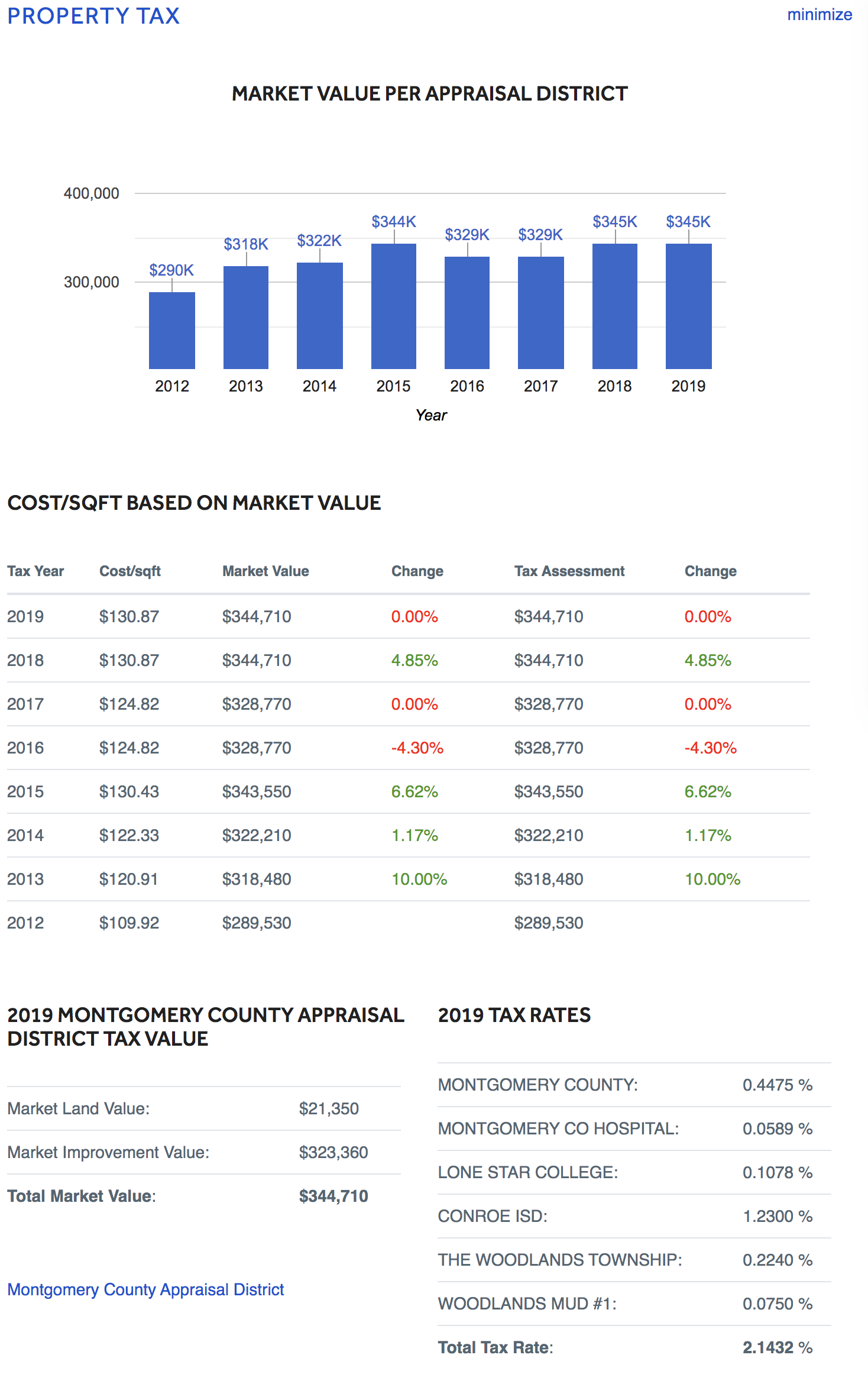

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message To G Selling House Tax Deductions Selling Your